Child TAx credit

additional child tax credit

other dependents credit

While the definitions of Qualifying Child & Dependent have not changed in 2018, what it means to the taxpayer has.

Social Security numbers are REQUIRED to be eligible for the Child Tax Credit & Additional Chid Tax Credit

The maximum amount for the Child Tax Credit has doubled over last year and

A new credit, Other Dependents Credit, has been added

With the elimination of the Personal Exemption deduction in 2018, this group of dependent credits are viewed as one way to minimize the negative effects of that change.

Even if taxpayers are not required to file a tax return, if eligible for the Child Tax Credit, they are in the group of taxpayers that SHOULD file a return.

The Credits - Who gets what?

There are 3 credits for Dependents that get divided into 2 groups.

Does your Qualifying Child or Dependent make you eligible for the

Child Tax Credit and the Additional Child Tax Credit? OR

NEW Credit for Other Dependents?

Child Tax Credit

Maximum $2,000 Child Tax Credit (CTC)

Nonrefundable credit. The best the Child Tax Credit can do is bring the taxpayer’s tax to $0.

NEW! The Qualifying Child MUST have a Social Security number.

The dependent

must be under the age of 17 on December 31, 2018

MUST have a social security number

For details see Pub 4012 p. G-12

Additional Child Tax Credit

$1,400 Additional Child Tax Credit

Refundable component of the CTC (above) is available to some taxpayers.

NEW! The Qualifying Child MUST have a Social Security number.

Available IF taxpayer did not enjoy the full benefit of the CTC, THEN the refundable Additional Child Tax Credit will be calculated.

The refundable $1,400 Additional Child Tax Credit is calculated subject to the taxpayer’s earned income above $2,500.

MAXIMUM Refundable amount of $1,400 Additional Child Tax Credit

Refundable amount is subject to EARNED INCOME above $2,500

ex. TP Earned Income $11,833

LESS: 2,500

Eligible Earnings $9,833

Factor x 15%

MAX refundable cr. $1,400

Example of how the Child Tax Credit and the Additional Child Tax Credit work together.

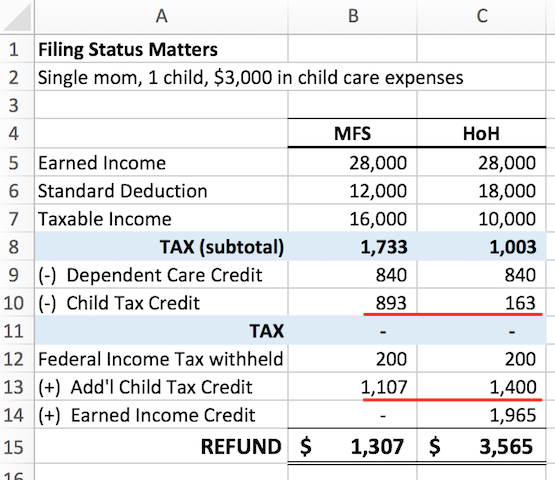

In the image below notice:

The nonrefundable CTC (shown on row 10) can only reduce tax to zero.

Additional Child Tax Credit (shown on row 13) can only

a) provide a MAX benefit of $2,000 when coupled with the CTC, (column B) or

b) provide a $1,400 refundable credit all subject to earned income over $2,500 (column C).

Other Dependents Credit (ODC)

$500 Other Dependents Tax Credit (ODC)

This credit is available for each Dependent who does not qualify for the CTC and is a resident of the United States.

the dependent (Qualifying Child) under age 17 without a social security number OR

the dependent (Qualifying Child) over age 17

other Qualifying Relative

For details see Pub 4012, p. G-14 and Table 2 on p. G-15

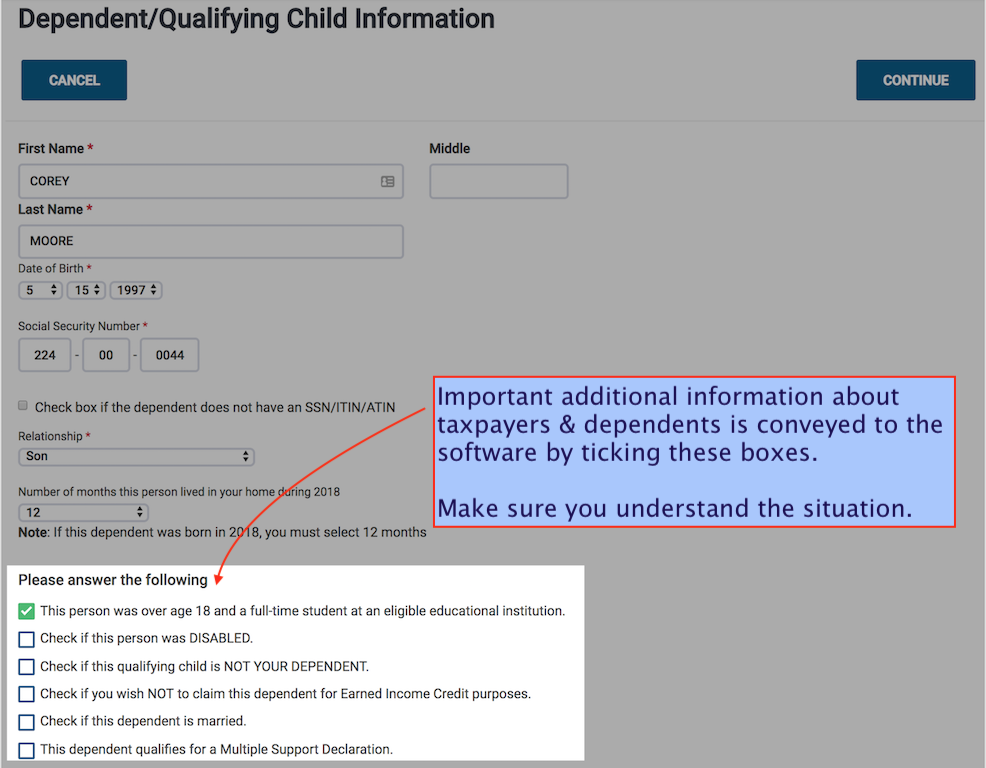

software input

There are no specific inputs into the tax software to award dependent tax credits to the taxpayer. There is no box to tick to ‘opt in’.

Eligibility will be determined by your inputs in the Basic Information section of the software.

Elections such as

filing status,

dependent’s relationship to taxpayer,

social security numbers or ITINs,

address (foreign address?)

birthdates

totally & permanently disabled

over 18 & a student

will be used by the software and evaluated to make the eligibility determinations.

Notice the TaxSlayer input screen for Credits (click for Pub 4012, p G-1) shown to you as a screenshot in Pub 4012 does not have a selection for Child Tax Credits.

Because there is no direct input for all of these dependent tax credits, the interview with the taxpayer is very important. Make sure you understand the taxpayer’s relationship with everyone listed in the Dependents section of the Intake & Interview sheet (bottom of page 1). You will input that information into the software, ticking appropriate boxes based on what you have determined.

Eligibility and appropriate tax credit amounts will be determined by the software, completely transparent to you.

Potential issues

For tax preparers, there are two potential issues with this behind-the-scenes calculation. The first one is obvious.

Are the results reasonable? The forms are different so the mechanics are different. The amounts are different from last year and the rules are different. So, you should ask yourself

Do the amounts make sense?

Do you need to recheck your data entry of Basic Information?

The second problem is more nuanced. While this new group of dependents credits will be beneficial to many taxpayers,

Some taxpayers won’t get the refund they were expecting.

You may have to explain this to them.

The Expectation Gap

The Child Tax Credit was promoted as a $2,000 credit, doubling 2017’s level, however, the refundable portion is set at $1,400.

Many of our AARP Tax-aide taxpayers do not have the income, and therefore the tax owed, to support the $2,000 level of the credit.

Looking at the illustration (below), notice that the tax on Line 11 would have to be at least $4,000 in order for a taxpayer with 2 dependents eligible for the Child Tax Credit to get the full amount.

The return would look something like this for a Taxpayer filing as Head of Household with 2 dependents:

REFUND v. Tax Credit

It is worth being explicit here that this is a huge expectation gap. The taxpayer thinks REFUND while the wording and subject is really Tax Credits.

What is a tax credit? It’s a credit against tax liability or tax owed.

Parsed even further, some tax credits are nonrefundable; where the best they can do is reduce the tax owed to $0 (zero dollars).

Other refundable tax credits are paid or “refunded” to the taxpayer despite the taxpayer owing $0 in tax. That is why we see the placement within the tax return of the refundable tax credits appearing after Line 15 of Form 1040 - Total Tax. (see Illustration 2 below)

When explaining this difference to a taxpayer it is helpful to have them imagine their own personal account where funds relating to this tax year get deposited; funds ready to be used to offset their tax liability for the year. The account holds all of their W-2 withholdings, 1099 withholdings, and the refundable tax credits that have been calculated. To determine the taxpayer’s Refund (Line 19), evaluate the

Account Balance (Line 18)

LESS: Tax Owed (Line 15)

= Amount OVERPAID (Line 19) the REFUND

Illustration 2. Form 1040, lines 12 - 18. On line 13 note that Nonrefundable credits - The best they can do is bring your tax to zero.