Brokerage Statements

This discussion is being presented because READING tax documents provided by brokerage firms are a major source of confusion for tax preparers.

The “What am I supposed to be looking for?” reaction is quite common.

Brokerage statements are just one of the many types of investment reporting documents that volunteers see when entering interest, dividends and capital gains.

At the bottom of this page are examples of the different formats these Brokerage Tax statements can take.

Fiduciary responsibility to report income to investors

Each year, investment houses that handle the financial investments of their clients are required to send year-end tax documents related to the income and capital gains that investments have earned throughout the year. They have a fiduciary duty to their clients to do this.

This type of income is called unearned income; while the owner of the investment goes skiing or sits reading a book, their investments are earning money for them.

Typically, these financial investments will earn some

interest

capital gains (through selling of stocks, bonds or mutual funds)

dividend income

maybe even some miscellaneous income

There is usually some income to report on the taxpayer’s return.

Remember, all income is taxable unless it is exempted by law.

Investment or brokerage firms organize these various types of income that flow into the account throughout the year.

The income is categorized and consolidated by type and sent to the client investor for them to report on their tax return. The income is also reported to the IRS.

Investment firms report the ANNUAL earnings on the 1099 series of informational forms.

First, they send a copy of the 1099 forms to the IRS.

Second, they send the taxpayer a copy of all relevant forms 1099.

Third, taxpayer files their tax return.

Fourth and finally, IRS computers run information matching routines to determine if all the income that has been reported to the IRS on 1099 forms by banks and investment companies has also been reported by taxpayers.

Tax consequences

[To be explicit, this discussion does NOT apply to any activity in tax-favored retirement accounts.]

Taxpayers MUST pay tax on their taxable investment income in the year it was earned even if they were

unaware and never alerted to the earnings OR

never received a check confirming the existence of earnings

Fiduciary responsibilities require that investment houses (ex. banks, credit unions, brokerage firms, insurance companies) provide informational forms to their clients for the unearned income that flows into accounts managed by them.

These income items are reported on a group of informational forms called the 1099 series. Most common to tax preparers are:

1099-DIV Dividends and Distributions

1099-INT Interest Income

1099-MISC Miscellaneous Income

1099-B Proceeds from Broker and Barter Exchange Transactions

Format can vary in these Tax Statements

WARNING! The Tax Reporting Statement is separate and distinct from the Annual Statement.

They have different purposes and different information.If the taxpayer presents you with their Annual Statement, you should ask them for their Tax Documents; they might go online to download it, ask their financial advisor to send them a duplicate - but maybe it is at home in their mail. It is highly unlikely that they did not receive a copy of this tax document.

This Tax Statement could be over 20 pages long.

Pro Tip 1

Staple ALL the pages together in numeric order.

Never mind that 6 pages probably look like this. (below)

Sample Tax StatementS

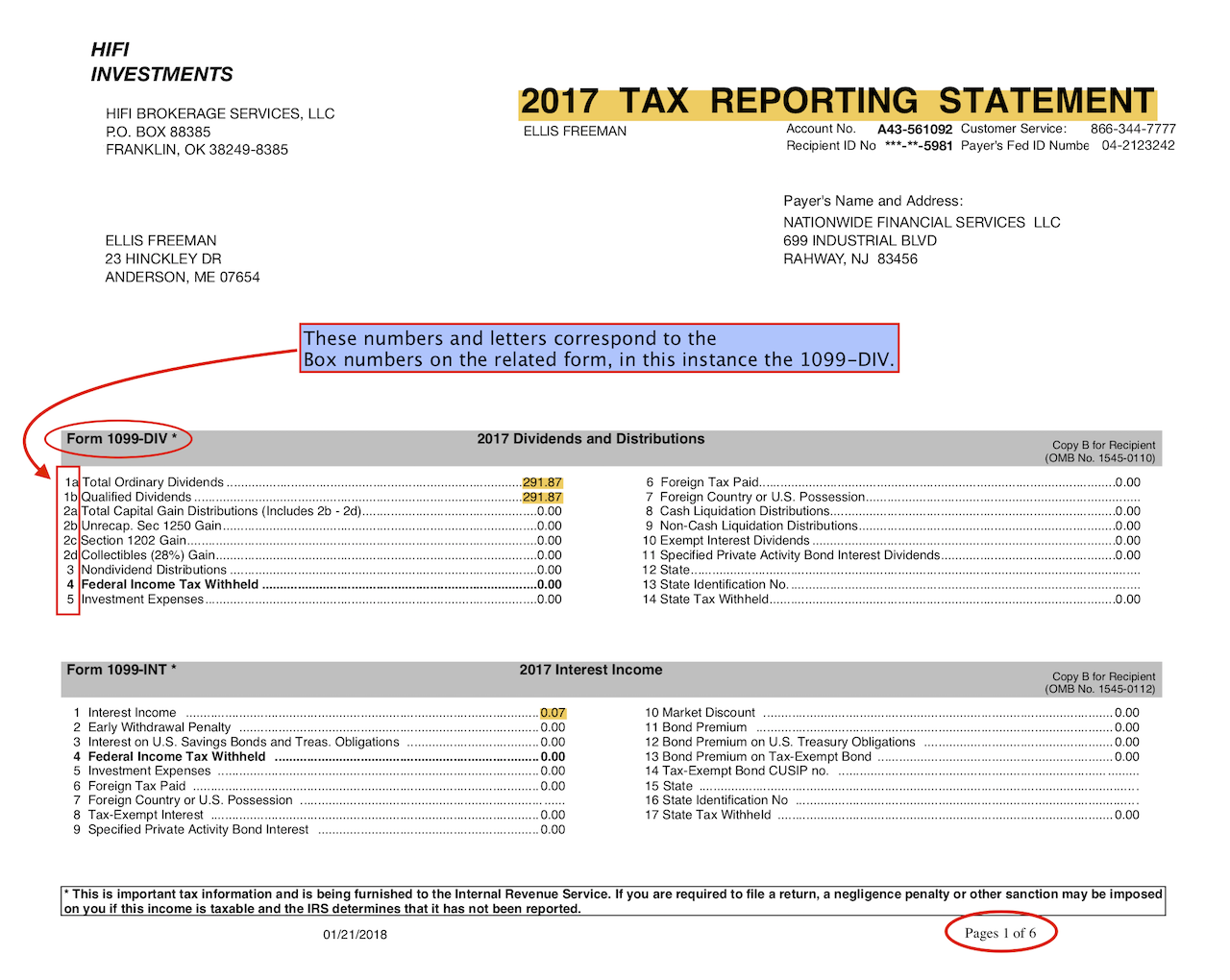

Below are two typical examples of a brokerage statement. One uses a format that resembles the look of the actual forms. The second uses a line numbering format that corresponds to the Box numbers on the 1099 Forms. They all match up.

Some things you are looking for

Correct year

Taxpayer name(s) match

Statement is a TAX summary

Various 1099 informational forms

Amounts

Details (if needed)

Alternative Presentation Format

Below is a different format of the same type of TAX reporting statement.

The box numbers (and letters) found on the 1099 forms have been used as the line descriptions (see far left column on example below)

Supplemental Tax Information

Sometimes you will have to look at the detail pages

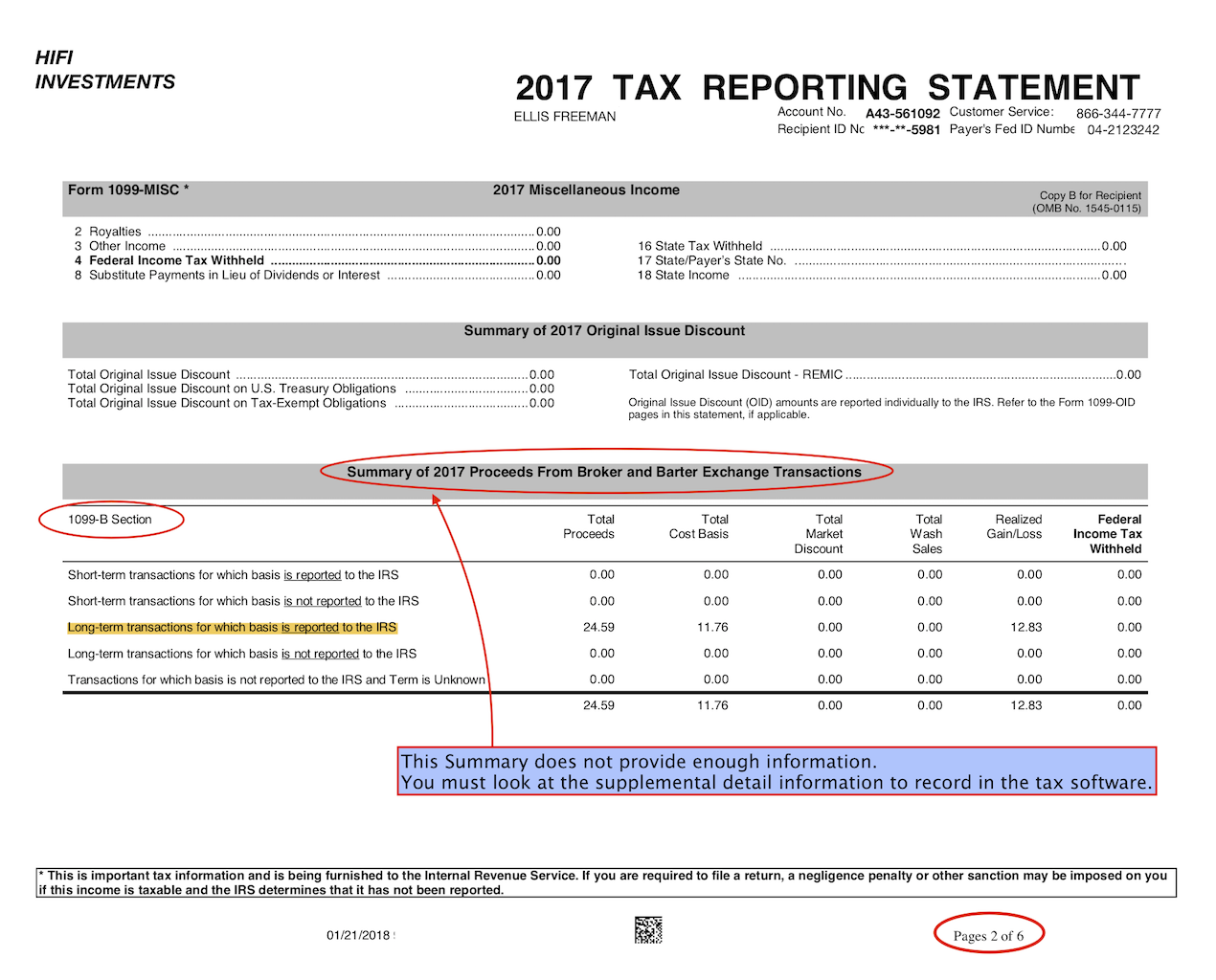

The 1099-B is a perfect example of one of those times.

Note that the presentation on the tax statement pages goes from the most consolidated information on the first couple of pages to the detail that supports the totals shown in each box or line at the end of the documents. (see examples)

If necessary, you are able to trace each CONSOLIDATED amount to the DETAIL amounts on the later pages. The detail pages are also where you find the granular explanation for codes and mystery amounts that are listed on the Summary pages.

In the example below there is a summary amount for Long Term capital gains in which the basis has been reported to the IRS. There is not enough information presented in this summary to record the transactions.

Scan through the document to find the detail.

Detail for this 1099-B Summary Report was found on page 4.

The detail (see below) provides the information needed to record the transaction.

The asset sold

Date acquired

Date sold

Proceeds

Cost

Long term (the asset was held for over 12 months)

Basis was reported to the IRS

EXTRAS

Example within an Example - (Advanced) As an aside note, the detail entry above “Cash in Lieu” is becoming a common transaction.

When companies spin-off or change their names, they most likely begin a new set of accounting books. Instead of recording fractional shares, they pay out the fractional shares to investors to keep their new books tidy. Most investors are completely unaware of these types of transactions. They don’t typically cause great tax implications but are, generally, just a mystery.

Reporting Deadlines

The consolidated tax information on unearned income (being discussed above) are usually prepared on separate Tax Documents, distinct from the Annual Statement. They are sent to clients by the end of January of each year. However, in most cases the deadline for the issuers (banks, etc) of these forms to report the results to the IRS is the end of February.

Sometimes, investors receive amended tax documents after their taxes have been prepared. This can cause worry & panic for the taxpayer. It is common for amended returns to be necessary because of this timing discrepancy.

CAUTION! Before opening up a return to amend it, make sure there is new and different information that will make a difference in the return. It is NOT necessary to amend a return, for example, to record 3 additional dollars in interest. Frequently in these cases, your Site Coordinator will already know the situation exists and will have formed a determination about how to proceed.

The IRS provides guidance on De Minimis Safe Harbor for errors in amounts on information returns in Notice 2017-09 U.S. 26 § 6721 (c)(3)(A).

De Minimis Error Safe Harbor to the I.R.C. §§ 6721 and 6722 Penalties