Tackling the Maine return

In the sections below you will find information about

Maine’s individual tax return - an overview.

Maine’s tax return begins with Federal Adjusted Gross Income (AGI). Because there are a few areas of nonconformity with Federal tax laws, modifications are made to arrive at Maine AGI.Modifications to Income found on Schedule 1

Modifications to Federal AGI to arrive at Maine AGI are compiled on Schedule 1.Schedule 1 - Additions when taxable by the state but not at Federal level.

Schedule 1 - Subtractions when taxable at the Federal level but not by the state.

Adjustments to Tax found on Schedule A

After taxable income has been derived and tax assessed, Adjustments to Tax are made in the form of tax credits on Schedule A. There is a tax credit worksheet for each tax credit. The tax software completes these worksheets in most cases. You can access those worksheets at Maine.gov Worksheets for Tax Credits - 2019 (click). These credits are reported onSchedule A, Section 1 if they are Refundable tax credits

Schedule A, Section 2 if they are Nonrefundable tax credits

Overview of The MAINE TAX Return

Maine imposes an income tax on all individuals that have Maine-source income.

The income tax rates range from 5.8% to 7.15% for tax years beginning after 2015.

In general, Maine tax laws conform with the federal tax code.

When Maine tax law does not conform with Federal law tax preparers must take a closer look to see if the taxpayer has reconciling modifications required in order to prepare an accurate Maine tax return. Often, a taxpayer’s Maine Adjusted Gross Income is identical to Federal Adjusted Gross Income. Maine pensioners are a specific group of taxpayers that almost always have reconciling adjustments to make.

Begin Maine tax return with Federal Adjusted Gross Income.

Click to see the Maine tax return Form 1040ME

Form 1040ME, Line 14. Start with Federal AGI brought over from the Federal return

Schedule 1 - Income Modifications. Make modifications to the Fed AGI based on the nonconforming laws. If the taxpayer’s Federal tax return has any items listed on Schedule 1, evaluate whether applying Maine tax law will cause that number to go up or down (is it an addition or a subtraction?)

Form 1040ME, Line 17. Reduce by Standard or Itemized Deductions.

Form 1040ME, Line 18. Reduce by Exemption amount.

Form 1040ME, Line 19. Arrive at taxable income.

Form 1040ME, Line 20. Calculate tax.

Form 1040ME, Line 22. Reduce tax by allowable tax credits that have been accumulated on Schedule A - Adjustments to tax. Section 1 of Sch A totals up the Refundable tax credits and Section 2 of Sch A totals up the Nonrefundable tax credits.

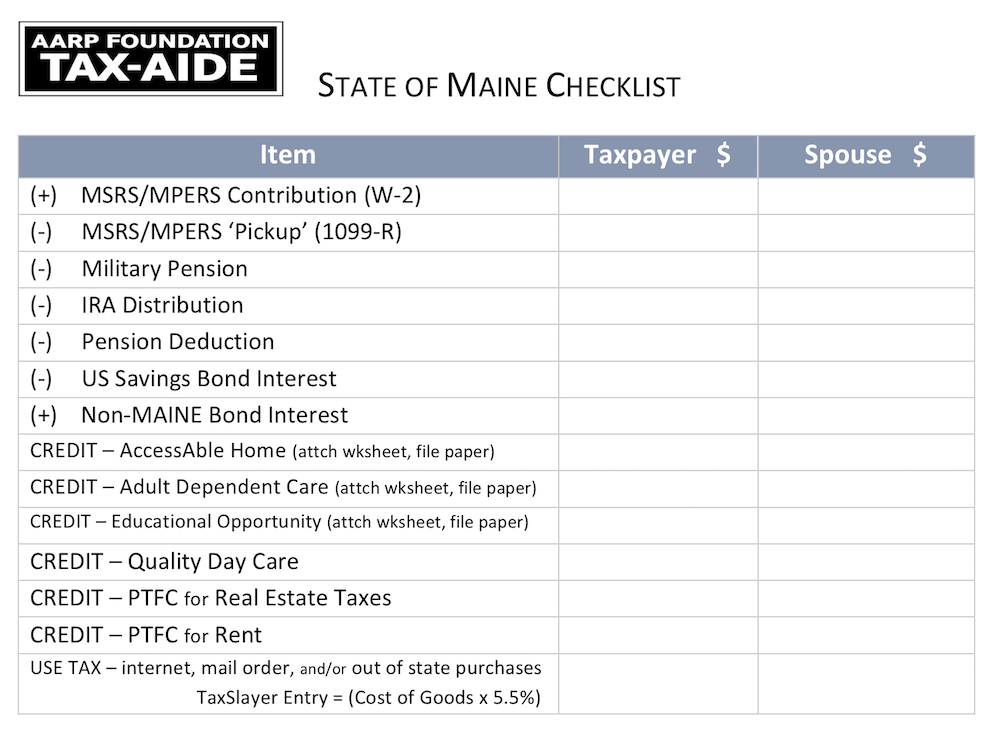

Checklist for preparing accurate Maine return.

Click for (checklist)

In order to keep track of modifications, adjustments and credits a checklist is used to assist with data entry into the Maine return.

A Reminder

This website is intended to provide insight and a frame of reference for your understanding. To guide your decision making, you must only use authoritative sources, IRS Publications and Instructions for federal tax guidance, and Maine Revenue instructions for state tax guidance.

Personal Exemption

Dependent exemption tax credit

Form 1040ME, Line 18 (and checkbox, line 13). A new area of nonconformity with the federal tax laws as described below in Maine Differences, is the Personal Exemption amount.

$4,200 ($8,300 MFJ).

Note that there is no amount provided for dependents. The negative impact of removing this exemption is mitigated by the Dependent Exemption Tax Credit (see below).

Nonrefundable tax credit up to $300 for each qualifying child and dependent of the taxpayer for whom the federal child tax credit was claimed.

Claimed on Sch A, Section 2, Line 8

ARRIVING AT MAINE AGI

Maine DIFFERENCES

You will hear other volunteers or instructors talk about ‘Differences’ or ‘Fed-State Differences’. This is what they are talking about.

In general, Maine tax laws conform with the federal tax code.

However, there exists differences in the treatment of some tax items which creates areas of nonconformity.

The major areas of nonconformity, such as pensions and tax exempt interest, will be discussed in the MAINE section of this website. Tax items that create these differences, those that have had an impact on Form 1040, will be evaluated at the Maine level to determine whether the Federal Adjusted Gross Income (AGI) will need to be modified to arrive at Maine AGI.

Calculating Maine Adjusted Gross Income. (image below)

Line 14. Federal AGI is brought over from the Federal return.

Line 15. Differences created by nonconforming tax laws. In total, this number may be negative or positive.

Line 16. Maine AGI

Getting started with the Maine return. To prepare the Maine Individual tax return, the biographical information that was entered when you first began the tax return in the Federal section of the software gets ‘pulled’ into the Maine state module. That biographical information along with Line 7, Form 1040 will populate Lines 1 - 14 of the Maine return (see Form 1040ME).

Step 1. (automatic) tax software brings the Basic Information and the taxpayer’s Federal AGI carried from Line 7, Form 1040 into the Maine module. You won’t see this on your screen but this step has the effect of populating Maine Form 1040ME, up to Line 14 (see ex. above)

Step 2. (manual adjustments requiring tax preparer attention) accumulate all of the items of nonconforming tax treatment and tally those up on Schedule 1 - Income Modifications, Line 3.

Step 3. (automatic) tax software will carry net amount from Schedule 1, Line 3 to Form 140ME, Line 15. Add or subtract Line 15 from Line 14 to arrive at Maine AGI.

Differences

The ‘correction’ of 1040ME, Line 14 - Federal AGI by reviewing all areas of nonconformity created by differences in Maine tax law is accomplished by the tax preparer addressing all areas of tax nonconformity that are present and entering the modifications on Schedule 1- Income Modifications.

We sometimes use a checklist to keep order. It is used to keep track of these required modifications as you prepare the federal return and then, as you prepare the Maine return, each entry on the checklist will be reviewed.

Finally, the checklist is a useful tool during the Quality Review stage of preparing the return.

NOTE: It is assumed that the Federal return has been completely prepared before starting the state return.

For a full explanation of the common Federal and Maine state differences for which manual entries are necessary in the Maine section of TaxSlayer tax software click here to go to the FED-STATE Differences page on this site.

Continue on to the FED-STATE Differences page.